Karnataka Man Wins Epic Refund Battle Against Car Dealership Over Unapproved Loan and Undelivered Vehicle | Bengaluru News

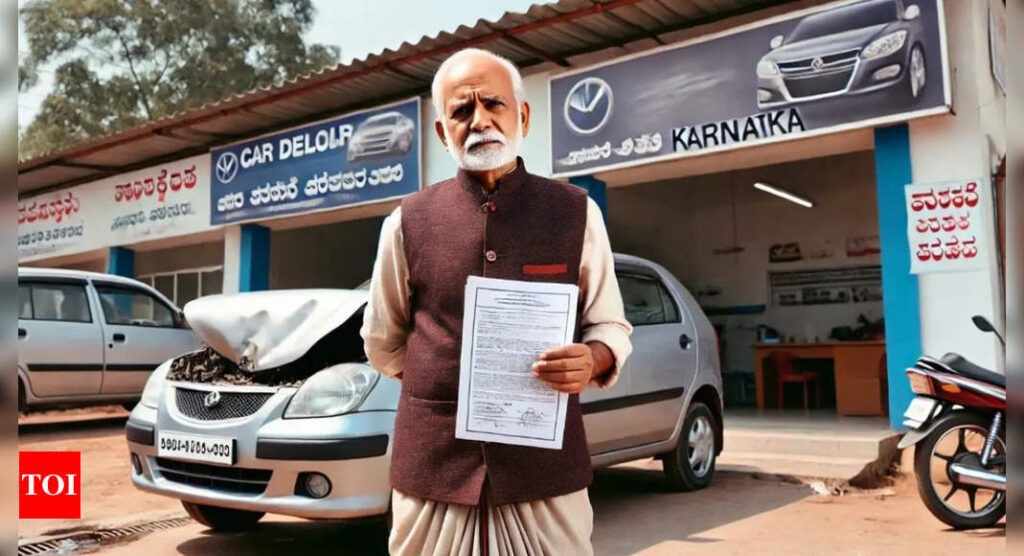

BENGALURU: After booking a Toyota Glanza and paying Rs 55,000 in advance, Thimmaraju was shocked to find himself pursued for loan repayments by Toyota Finance Services—despite neither taking a loan nor receiving the car.

Thimmaraju’s attempts to get a refund from Viva Magna Wheelers, the dealership, proved futile, prompting him to approach the Bangalore Additional District Consumer Disputes Redressal Commission.

The story began in May 2022. Thimmaraju, a 51-year-old resident of Mutsandra, decided to purchase a Toyota Glanza. He booked the vehicle by paying Rs 5,000 on May 6, followed by an advance payment of Rs 50,000 on May 31. The dealership assured him that the car would be delivered within two months. However, delays began to pile up, with the dealership citing vague reasons for postponing the delivery.

To make matters worse, Thimmaraju received a message from Toyota Finance Services about an overdue EMI for a loan he never availed. According to the message, he supposedly took a loan of Rs 6 lakh with an EMI of Rs 12,568. Shocked by this, Thimmaraju repeatedly contacted the dealership to clarify the matter and demand a refund of his booking amount. Despite his efforts, the dealership failed to provide clarity or return his money.

When all attempts to resolve the matter failed, Thimmaraju issued a legal notice on January 2, 2023. However, the dealership’s response was dismissive, claiming that the loan was sanctioned with his consent and that Rs 33,000 was deducted as cancellation charges, leaving only Rs 22,000 to be refunded. Left with no option, the elderly filed a complaint at the commission on June 13, 2023.

In its defence before the Commission, the dealership argued that Thimmaraju himself requested the loan and later changed his preference for the car’s colour from silver to red, causing further delays. They claimed that Thimmaraju failed to pay the remaining amount or collect the vehicle, eventually prompting the cancellation of the booking.

The dealership maintained that the deduction of Rs 33,000 as loan cancellation charges was valid. However, they could not provide any documentary evidence to support their claims, including proof of the loan approval or correspondence regarding the change in vehicle colour.

After reviewing the evidence, the Commission concluded that the dealership failed to prove its claims or justify the loan cancellation charges. The commission noted that the dealership, as a car dealer, lacked the authority to impose cancellation charges for a loan that the complainant denied availing. Furthermore, the dealership’s failure to produce any supporting documents undermined its defence, citing deficiency in service.

The Commission passed judgment on November 25 this year, ordering Viva Magna Wheelers to refund Rs 55,000 to Thimmaraju within one month. The dealership was also ordered to pay interest at 6.5% per annum on the amount if the payment was delayed beyond one month, and Rs 2,000 as litigation costs.